1. Internally generated loss

2. Vendor generated loss caused by suppliers and other partners

3. Administrative, paper-generated loss or masking impact

by Ernie Deyle

Posted on August 11, 2023 at 9:00 AM

Every day, we read headlines like “Retailers Losing Billions” or “ More Retail Bankruptcies Are Brewing”.

A top Homeland Security official called Organized Retail Crime an absolute threat to public safety and the economy.

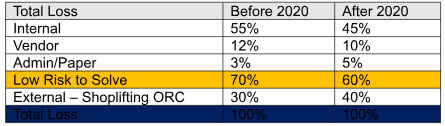

Coupled with the shocking viral videos, one would think that the only cause of Total Retail Loss is Organized Retail Crime (ORC). We know that is not 100% accurate. Let’s all take a deep breath and consider the following strategies to help drive performance while mitigating enterprise-wide risk.

External Loss is one of four buckets that Loss Prevention/Asset Protection leaders have used for decades.

The other three buckets of loss are:

1. Internally generated loss

2. Vendor generated loss caused by suppliers and other partners

3. Administrative, paper-generated loss or masking impact

What’s unique about the three buckets is the fact that these are entirely under a retailer’s control. If the retailer is leveraging data analytics to deliver performance insights, the retailer can isolate and quantify gaps between business expectations and outcomes. Not only can this be done with limited risk, it also allows the retailer to contain and stabilize the gaps.

Gaps typically occur when operational execution breaks down. For example, a store associate completes a transaction using a work-around. Short cuts can also occur when a vendor, knowingly or unknowingly uses a shortcut to complete a task.

Operational execution also breaks down when an associate or vendor partner alters or manipulates an event, transaction, task or action intentionally to benefit themselves or someone else. That is fraud, theft or embezzlement.

When taking action to address the three internally controllable buckets of loss, there is minimal risk. There are limited concerns about collateral damage to property. There is very little risk to people, including associates, vendor partners or customers. The risk is contained internally with limited collateral damage.

However, when addressing External Loss, the risk has skyrocketed across the board. From collateral damage to property, additional loss of inventory and increased physical harm to associates, vendors and even customers. Sadly, the escalation of collateral damage includes physical harm and even death.

At Freeing Returns, we provide retailers tools to isolate and quantify the gap between expectations and outcomes. You can determine performance erosion and pinpoint where it’s coming from. Avoid misattributions of P&L by determining if it was a vendor/partner-generated loss or internally-generated loss.

Schedule a demo to find out more about our solution today.